Non-Homestead Millage

What does non-homestead mean?

This is a tax on industrial, commercial, and some agricultural property and second homes (non-homestead property). It is NOT a tax on a family’s primary home.

What does this millage fund?

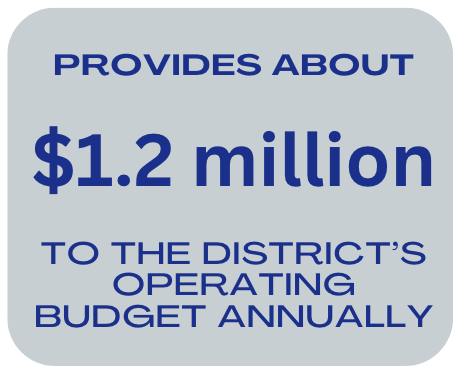

The money the district receives from the non-homestead operating millage supports the district’s day-to-day operations, including salaries for teachers and staff, and programs for students. It represents about $1.2 million of the overall General Fund budget.

What if the millage is not renewed?

If voters do not approve this renewal on or before August 6, 2024, the State of Michigan WILL NOT replace the funding and Oakridge Public Schools will be forced to reduce or cut programs to offset the loss.

This proposal will allow the school district to continue to levy the statutory rate of not to exceed 18 mills on all property, except principal residence and other property exempted by law, required for the school district to receive its full revenue per pupil foundation allowance and restores millage lost as a result of the reduction required by the Michigan Constitution of 1963.

Shall the currently authorized millage rate limitation on the amount of taxes which may be assessed against all property, except principal residence and other property exempted by law, in Oakridge Public Schools, Muskegon and Newaygo Counties, Michigan, be renewed by 18.1513 mills ($18.1513 on each $1,000 of taxable valuation) for a period of 5 years, 2026 to 2030, inclusive, and also be increased by .5 mill ($0.50 on each $1,000 of taxable valuation) for a period of 5 years, 2026 to 2030, inclusive, to provide funds for operating purposes; the estimate of the revenue the school district will collect if the millage is approved and 18 mills are levied in 2026 is approximately $1,125,000 (this is a renewal of millage that will expire with the 2025 levy and the addition of millage which will be levied only to the extent necessary to restore millage lost as a result of the reduction required by the "Headlee" amendment to the Michigan Constitution of 1963)?

[ ] YES

[ ] NO

Why is this vote necessary?

Under state law, the local 18 mill school operating millage expires periodically requiring the local electorate to hold an election for consideration of renewal. For Oakridge Public Schools to continue receiving the full State Foundation Allowance for each student, this millage must be renewed by the voters from time to time.

How does the district use the funds?

The money the district receives from the Non-Homestead Millage supports the school district's day-to-day operations, including salaries for teachers and staff, and represents approximately 7% (or $1.2 million) of the overall General Fund budget.

Is this a new tax?

No – this is a renewal of a millage approved by the voters. Oakridge brings this renewal to voters approximately every 5 years. The district has voter approval to levy 18.0000 mills on non-homestead property through the 2025 levy. If the renewal is approved by voters, it will be levied from 2026 to 2030.

Why is the election being called so far in advance of the expiration date? Why doesn’t the district wait until closer to the expiration date?

Holding the election on August 6, 2024, an already existing primary election date, allows the district not to have to pay for election fees. Waiting for another election date where this proposal was the only item on the ballot would require the district to pay the full cost of holding the election.

What does the State expect?

The State of Michigan expects Oakridge Public Schools to collect the full amount of the non-homestead millage. The State does not make up the difference in revenue if Oakridge Public Schools does not collect it through this voter-approved millage.

What if the millage is voted down?

If this renewal millage does not pass, the State WILL NOT replace the funding and Oakridge Public Schools will be forced to reduce or cut programs to offset the loss.

How are Michigan school districts funded?

Districts receive most of their funding on a per-pupil basis. The amount a school district receives per pupil is called the Foundation Allowance. The per-pupil Foundation Allowance for Oakridge Public Schools is currently $9,608. This represents a significant portion of Oakridge Public Schools’ revenue and is funded from 2 sources: 1.) Local Revenue – 18 mills collected on non-homestead property, and 2.) State Revenue.

By law, Oakridge Public Schools must collect a local “non-homestead” operating millage for this portion of its budget to obtain the full Foundation Allowance amount.

Can the district use bond money to cover the cost?

No, bond funds are legally restricted to bond projects and CANNOT be used for general fund expenditures. The final 2019 bond funded projects are being completed this summer! The bond funds have been spent.

How is the 18 mill non-homestead renewal different from a bond millage?

A bond millage is used explicitly for renovation, instructional equipment, site improvements,buildings, and additions. Bond dollars cannot be used for the District’s general operations. The 18 mill non-homestead millage renewal is specific to the general operations of the District and will mean a loss of funding if not approved. The state does not make up this revenue if the voters do not approve the proposal.

Voters approved the Non-Homestead Operating Millage on August 6, 2024, for the 5 year period of 2026-2030.